FTX Restart and Liquidation Progress

Ongoing FTXExchangeRegulation

After FTX's bankruptcy, a series of negotiations and competitions have taken place around restarting, liquidating, and repaying creditors, with multiple significant fluctuations in related assets.

Start Date: Jul 3, 2025

Timeline Events: 11

Duration: 54 days

Event Timeline

Sort by:

May 30, 2025

Started distributing $5 billion to qualifying creditors through platforms like BitGo and Kraken, with 74% of customers receiving repayments

May 15, 2025

FTX Recovery Trust announced that over $5 billion would be distributed to creditors on May 30, 2025.

Key amount: $5 billion, second distribution

Mar 31, 2025

Announced that repayments would begin on May 30, 2025, to major creditors, based on the value of cryptocurrencies in 2022.

Key amount: $11.4 billion

Dec 16, 2024

It was reported that customers with claims below $50,000 would begin receiving repayments in early 2025.

Key event: small claim compensation began

May 8, 2024

FTX announced that almost all customers would recover their funds, marking two years since the bankruptcy.

Key event: customer repayment plan announced

Jan 31, 2024

FTX decided to liquidate to repay customers in full, with lawyer Andy Dietrich stating that the cost of restarting was too high.

Key event: decision to liquidate

Oct 24, 2023

FTX discussed with three bidders about the restart plan, expected to be decided by mid-December 2023.

Key event: negotiation stage

Aug 1, 2023

FTX submitted a restructuring plan, proposing the possibility of restarting the exchange and providing new exchange equity as compensation to customers.

Key event: submission of restructuring plan

Apr 12, 2023

FTX considered using creditor funds to support the restart, still in early stage discussions.

Key event: consideration of using customer funds

Jan 19, 2023

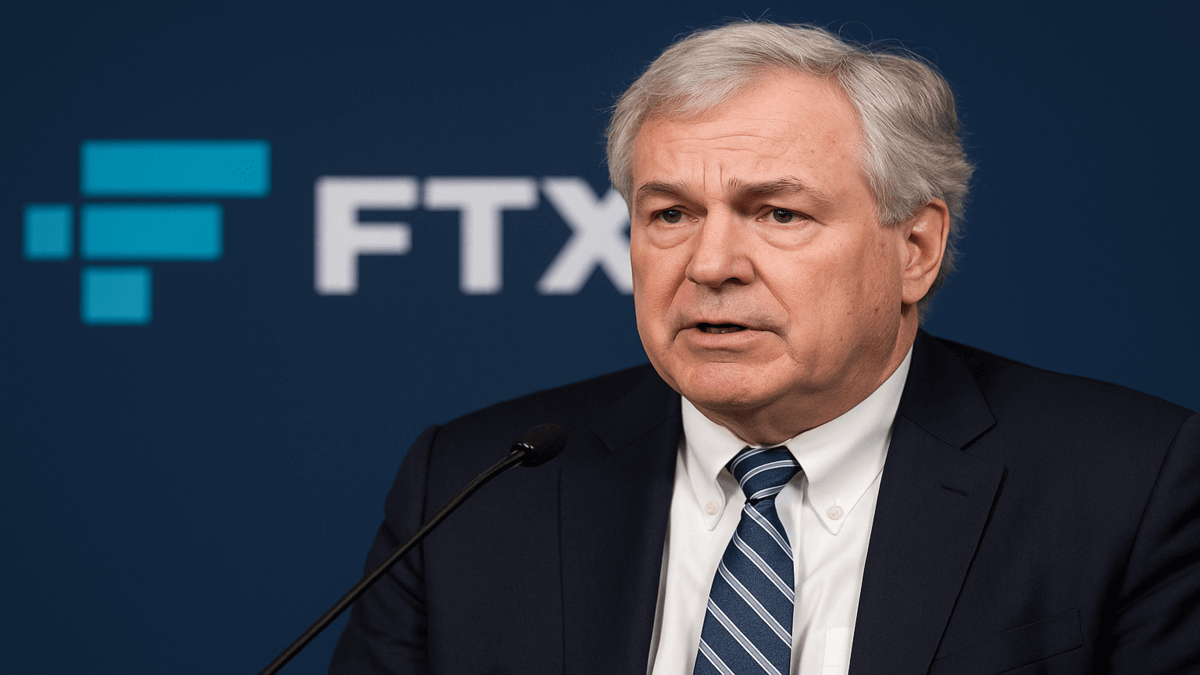

John R. Reed, new CEO of FTX, announced the exploration of the possibility of restarting the exchange, establishing a task group to assess feasibility.

Key figure: John R. Reed